CIMAPRO17-BA2-X1-ENG Exam Questions & Answers

Exam Code: CIMAPRO17-BA2-X1-ENG

Exam Name: E3 - Strategic Management Question Tutorial

Updated: Nov 16, 2024

Q&As: 60

At Passcerty.com, we pride ourselves on the comprehensive nature of our CIMAPRO17-BA2-X1-ENG exam dumps, designed meticulously to encompass all key topics and nuances you might encounter during the real examination. Regular updates are a cornerstone of our service, ensuring that our dedicated users always have their hands on the most recent and relevant Q&A dumps. Behind every meticulously curated question and answer lies the hard work of our seasoned team of experts, who bring years of experience and knowledge into crafting these premium materials. And while we are invested in offering top-notch content, we also believe in empowering our community. As a token of our commitment to your success, we're delighted to offer a substantial portion of our resources for free practice. We invite you to make the most of the following content, and wish you every success in your endeavors.

Download Free CIMA CIMAPRO17-BA2-X1-ENG Demo

Experience Passcerty.com exam material in PDF version.

Simply submit your e-mail address below to get started with our PDF real exam demo of your CIMA CIMAPRO17-BA2-X1-ENG exam.

![]() Instant download

Instant download

![]() Latest update demo according to real exam

Latest update demo according to real exam

* Our demo shows only a few questions from your selected exam for evaluating purposes

Free CIMA CIMAPRO17-BA2-X1-ENG Dumps

Practice These Free Questions and Answers to Pass the CIMA Certifications Exam

The following data are available for a company that produces and sells a single product.

The company's opening finished goods inventory was 2,500 units.

The fixed overhead absorption rate is $8.00 per unit.

The profit calculated using marginal costing is $16,000.

The profit calculated using absorption costing and valuing its inventory at standard cost is $22,400.

The company's closing finished goods inventory is:

A. 3,300 units

B. 1,700 units

C. 3,900 units

D. 8,900 units

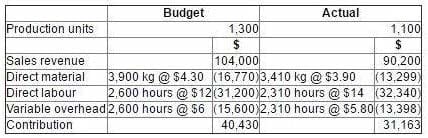

Data for the latest period for a company which makes and sells a single product are as follows:

There were no budgeted or actual changes in inventories during the period. The sales volume contribution variance for the period was:

A. $6,220 adverse.

B. $9,267 adverse.

C. $16,000 adverse.

D. $5,666 adverse.

In responsibility accounting, costs and revenues are grouped according to:

A. the budget holder.

B. their function.

C. the service provided.

D. their behaviour.

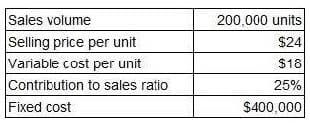

An organisation produces and sells a single product. The organisation's management accountant has reported the following information for the most recent period.

Which TWO of the following statements are valid? (Choose two.)

A. If the contribution to sales ratio changed to 30%, the breakeven point would become higher.

B. If the fixed cost changed to $445,000, the breakeven point would not change.

C. If the sales volume changed to 220,000 units, the breakeven point would not change.

D. If the selling price changed to $22 per unit, the breakeven point would become lower.

E. If the variable cost changed to $16 per unit, the breakeven point would become lower.

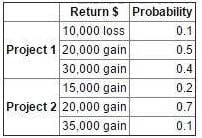

The possible returns and associated probabilities of two independent projects are as follows:

It has been decided that both projects are to be launched.

Which TWO of the following statements are correct? (Choose two.)

A. The expected value of the total return is $41,500 gain.

B. The probability of the total return being a loss is 0.10.

C. The probability of making a total return of exactly $5,000 gain is 0.02.

D. The probability of the total return being a gain is less than 1.00.

E. The expected value of the total return is $40,000 gain.

Viewing Page 1 of 3 pages. Download PDF or Software version with 60 questions