CIMAPRO19-P02-1 Exam Questions & Answers

Exam Code: CIMAPRO19-P02-1

Exam Name: P2 - Advanced Management Accounting

Updated: Nov 16, 2024

Q&As: 202

At Passcerty.com, we pride ourselves on the comprehensive nature of our CIMAPRO19-P02-1 exam dumps, designed meticulously to encompass all key topics and nuances you might encounter during the real examination. Regular updates are a cornerstone of our service, ensuring that our dedicated users always have their hands on the most recent and relevant Q&A dumps. Behind every meticulously curated question and answer lies the hard work of our seasoned team of experts, who bring years of experience and knowledge into crafting these premium materials. And while we are invested in offering top-notch content, we also believe in empowering our community. As a token of our commitment to your success, we're delighted to offer a substantial portion of our resources for free practice. We invite you to make the most of the following content, and wish you every success in your endeavors.

Download Free CIMA CIMAPRO19-P02-1 Demo

Experience Passcerty.com exam material in PDF version.

Simply submit your e-mail address below to get started with our PDF real exam demo of your CIMA CIMAPRO19-P02-1 exam.

![]() Instant download

Instant download

![]() Latest update demo according to real exam

Latest update demo according to real exam

* Our demo shows only a few questions from your selected exam for evaluating purposes

Free CIMA CIMAPRO19-P02-1 Dumps

Practice These Free Questions and Answers to Pass the CIMA Certifications Exam

A company has invested $500,000 in developing a new product and requires a return of 12% on this investment.

The company has researched the market and has set the selling price for the new product at $300 per unit. At this price, sales volume for next year is forecast to be 500 units. The forecast unit cost is $210.

What is the target cost gap per unit for the coming year? Give your answer to the nearest whole $.

A. $30

A company is considering four mutually exclusive projects. There are three possible future demand conditions but the company has no idea of the probability of each of these demand conditions occurring. The forecast net present values (NPVs) of each of the four projects, under each of the three possible future demand conditions, are as follows.

Using the maximax criterion, which investment should be selected?

A. Investment A

B. Investment B

C. Investment C

D. Investment D

A company operates a divisional structure. The manager of division D receives a bonus based on the division's annual return on capital employed (ROCE).

A minimum ROCE of 20% must be achieved to receive any bonus and thereafter the bonus increases in line with increases in ROCE.

This year division D achieved a ROCE of 24% and the divisional manager received a large bonus. The manager is considering an investment in a new machine for next year. The incremental ROCE earned by the machine is expected to be

19% although the ROCE for the division as a whole with the machine is expected to be 22%. Without the machine, ROCE is likely to be stable at 24%. The cost of capital for the company as a whole is 18% per year.

Which of the following statements is correct?

A. The manager will accept the investment because overall the division will earn a ROCE that exceeds the minimum target of 20%.

B. The manager will reject the investment because it will result in a lower bonus than without the investment.

C. The manager will accept the investment because it will earn a ROCE that is higher than the company's cost of capital.

D. The manager will reject the investment because it will result in the receipt of no bonus.

A manufacturing company has recently introduced a Total Quality Management (TQM) system. The company has invested heavily in the education and training of its staff, in addition to implementing new product design engineering. There is

a plan to sample units from each batch of products manufactured to test for errors, although this has not yet been implemented due to budget constraints.

The company is experiencing high levels of customer complaints, with many faulty units being returned by the customer for refund or replacement. Sales revenue has fallen recently, mainly due to negative press coverage linked to dissatisfied

customers.

Select the statement MOST likely to apply.

A. The high level of external failure costs is the result of a lack of expenditure on prevention costs.

B. The high level of internal failure costs is the result of a lack of expenditure on appraisal costs.

C. The high level of external failure costs is the result of a lack of expenditure on appraisal costs.

D. The high level of internal failure costs is the result of a lack of expenditure on prevention costs.

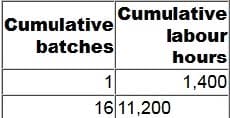

A company has just completed the production of the first 16 batches of a product. A learning curve has been observed throughout. The following table gives further details.

To the nearest whole percentage, what rate of learning is implied?

A. 87%

B. 8%

C. 84%

D. 93%

Viewing Page 1 of 3 pages. Download PDF or Software version with 202 questions