CPA-TEST Exam Questions & Answers

Exam Code: CPA-TEST

Exam Name: Certified Public Accountant Test: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, Regulation

Updated: Nov 17, 2024

Q&As: 1241

At Passcerty.com, we pride ourselves on the comprehensive nature of our CPA-TEST exam dumps, designed meticulously to encompass all key topics and nuances you might encounter during the real examination. Regular updates are a cornerstone of our service, ensuring that our dedicated users always have their hands on the most recent and relevant Q&A dumps. Behind every meticulously curated question and answer lies the hard work of our seasoned team of experts, who bring years of experience and knowledge into crafting these premium materials. And while we are invested in offering top-notch content, we also believe in empowering our community. As a token of our commitment to your success, we're delighted to offer a substantial portion of our resources for free practice. We invite you to make the most of the following content, and wish you every success in your endeavors.

Download Free AICPA CPA-TEST Demo

Experience Passcerty.com exam material in PDF version.

Simply submit your e-mail address below to get started with our PDF real exam demo of your AICPA CPA-TEST exam.

![]() Instant download

Instant download

![]() Latest update demo according to real exam

Latest update demo according to real exam

* Our demo shows only a few questions from your selected exam for evaluating purposes

Free AICPA CPA-TEST Dumps

Practice These Free Questions and Answers to Pass the AICPA Certifications Exam

In testing long-term investments, an auditor ordinarily would use analytical procedures to ascertain the reasonableness of the:

A. Completeness of recorded investment income.

B. Classification between balance sheet portfolios.

C. Valuation of marketable equity securities.

D. Existence of unrealized gains or losses in the portfolio.

A general partnership must:

A. Pay federal income tax.

B. Have two or more partners.

C. Have written articles of partnership.

D. Provide for apportionment of liability for partnership debts.

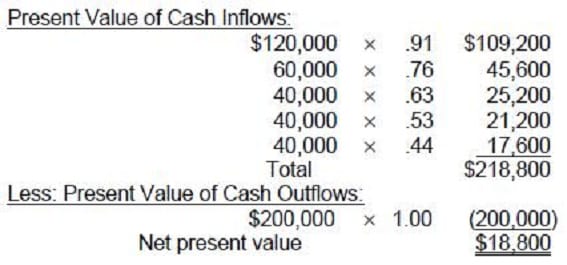

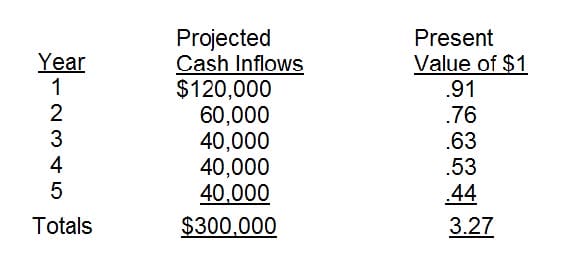

The ABC Company is planning a $200,000 equipment investment, which has an estimated five-year life with no estimated salvage value. The company has projected the following annual cash flows for the investment.

The net present value for the investment is:

A. $18,800

B. $196,200

C. $(3,800)

D. $91,743

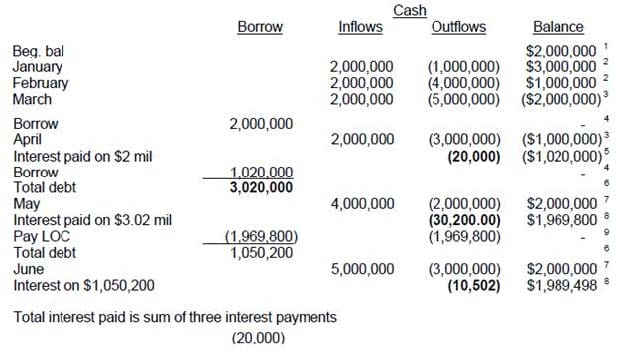

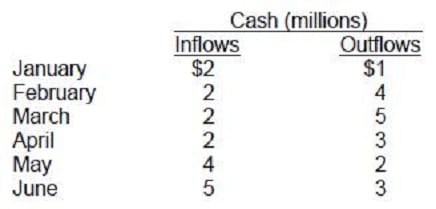

The treasury analyst for ABC Manufacturing has estimated the cash flows for the first half of next year (ignoring any short-term borrowings) as follows:

ABC has a line of credit of up to $4 million on which it pays interest monthly at a rate of 1 percent of the amount utilized. ABC is expected to have a cash balance of $2 million on January 1 and no amount utilized on its line of credit. Assuming all cash flows occur at the end of the month, approximately how much will ABC pay in interest during the first half of the year?

A. $61,000

B. $80,000

C. $132,000

D. $240,000

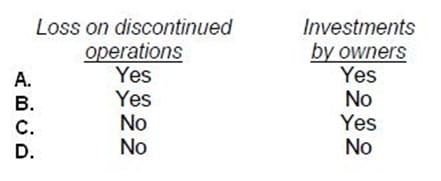

According to the FASB conceptual framework, comprehensive income includes which of the following?

A. Option A

B. Option B

C. Option C

D. Option D

Viewing Page 1 of 3 pages. Download PDF or Software version with 1241 questions